Indian Prime Minister Narendra Modi’s recent victory in the national elections was muted at best. While he secured a rare third term in the nation’s highest office, his decisive legislative supermajority failed to materialize. Modi has made revitalizing the Indian economy and increasing foreign direct investment (FDI) a cornerstone of his pro-business platform. With markets adjusting to the unexpected outcome and new legislative circumstances, he and his party now pursue cementing the economic gains generated in his earlier terms, to ensure India continues making strides towards a modern capitalist economy that includes the wider populations and supports all Indians. Global markets will be monitoring the composition of the new cabinet and the introduction of the budget in July to ascertain that the Modi doctrine remains relevant, pro-business, and above all else, pro-India.

THE PATH TOWARDS DEVELOPED MARKET STATUS

With the final tally for India’s election posted, Prime Minister Narendra Modi will succeed to a third term; however, polling forecasts advising that Modi’s party and the alliance it formed would claim a decisive landslide victory has been frustrated by a much stronger-than-expected showing representing the coalition of opposition parties. Poorer regions of the country joined forces to thwart the pro-business agenda underpinning the Modi platform, which was championed by the country’s billionaire class. The surprise electoral setback denied Modi’s Bharatiya Janata party (BJP) the strong majority it needed to conclusively advance economic policies that have underpinned India’s success in attracting both FDI and global investor interest, coupled with the prized status of becoming one of the fastest-growing global economies.

Leading up to the election, investors had been rattled by the possibility that a Modi victory could be weakened by a smaller voter turnout or the prospect of winning fewer seats in the lower house of parliament, which would result in muted support for his mandate to drive the economy and investment. Market performance reflected these concerns.

The pro-growth platform espoused by Modi and the BJP coalition included the promise of transitioning India from an “emerging market” to a “developed market,” a theme he referred to in 2022 when he urged Independence Day crowds to think in terms of becoming a developed country within 25 years as his policies would focus on efforts to upgrade infrastructure, power production, defense, and digital technology.

Now, earlier concerns have been realized as to how Modi — the driving force in India’s modernization — will be able to successfully navigate any opposition to move forward with his agenda and hopes for a future “developed” India.

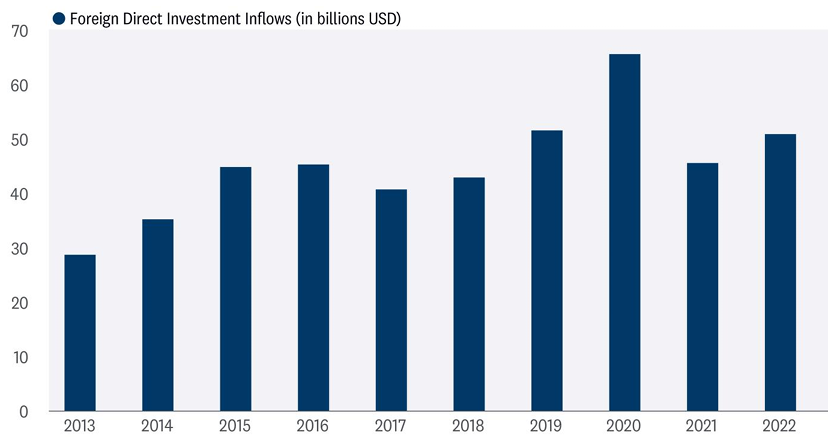

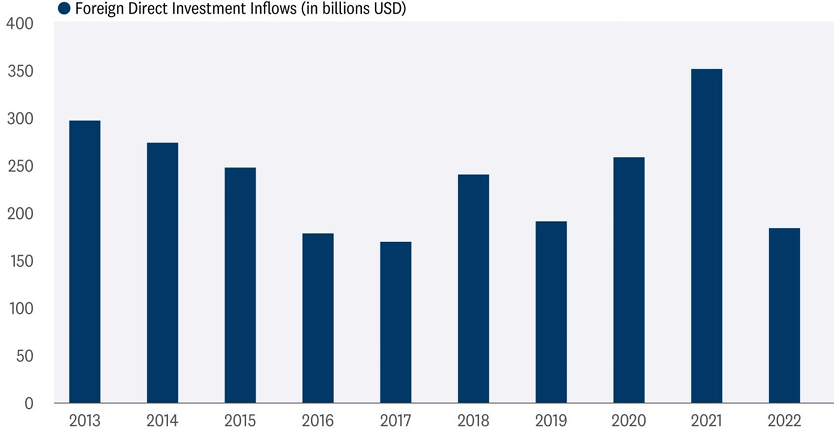

INDIA WORKS TO MAINTAIN HIGHER FDI

Source: LPL Research, The World Bank 06/03/24

ELECTION CONCERNS BEGIN TO SUBSIDE DESPITE A SHALLOW VICTORY

The Indian equity market had been struggling leading up to the election as many traders bet against the market out of concern that Modi and the BJP couldn’t secure the kind of compelling victory that would allow the pro-growth approach to continue at a faster pace. Global funds withdrew approximately $3 billion from domestic shares from the start of the year as worries escalated that Modi’s attempt to secure a third term could be thwarted by his platform not receiving enough votes to declare a broad enough mandate for commanding economic growth.

The multi-phase six-week-long election season included Modi’s attempt to reach voters beyond a business-only platform, which included welfare measures for areas of the country that remain exceedingly poor, and a Hindu-led narrative that found appeal among the wider Indian population despite rising concern from the Muslim minority. But it wasn’t enough, as the stark inequality between Modi’s billionaire supporters and a large swath of the population who earn less than $4 a day became a fundamental — and successful — theme for the opposition.

MARKETS TRYING TO ADJUST

With expectations that the government would focus on capital expenditures directed towards power generation and infrastructure, utilities edged higher, as did private and state-owned companies associated with the infrastructure buildout. Now analysts are adjusting their expectations as questions about Modi’s ability to forge a budget consensus are questioned. Modi ruled with authority backed by voters and through the force of his dominant personality, and now he’s being forced to work with a multitude of opposition party factions.

Still, most analysts contend it will be difficult to dismantle the reform program, and that a series of checks and balances within the newly formed government could provide the transparency needed for further FDI and global fund inflows.

India’s Sensex Index has begun to recover as domestic investors, particularly banks and mutual funds, took advantage of the selloff. Analysts continue to monitor flows from global investors to measure whether they remain convinced that the Modi juggernaut has enough influence to power his agenda. The composition of the new cabinet will provide a significant indication of Modi’s remaining influence.

FDI GROWS AT A RAPID PACE

FDI in India grew at a rapid pace as the Modi administration provided stability and insurance that the pro-business agenda was intact and reliable. The regulatory framework was codified, and endorsements from well-known brands helped bolster support for viewing India as a country hospitable to foreign enterprises.

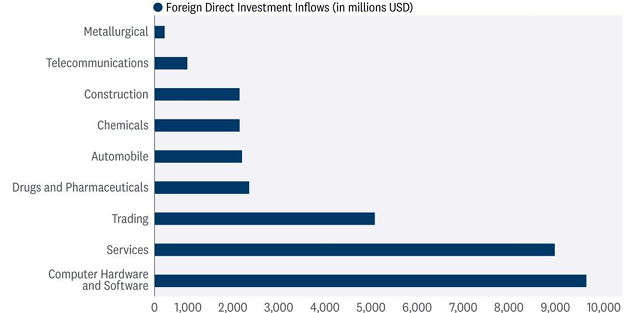

COMPUTER HARDWARE AND SOFTWARE ATTRACTS THE MOST FDI DURING FISCAL YEAR 2023

Source: LPL Research, Forbes 06/03/24

Moreover, FDI in China withered as its economy stagnated during and after the COVID-19 shutdown, but it was mounting concern focused on President Xi Jinping’s leadership that helped re-direct FDI towards India. Modi’s reform agenda and a comparatively more transparent and stable government offered a viable alternative to China. The expansive Indian market of 1.4 billion people has increasingly been viewed as providing foreign companies with an affordable base for operations and access to a growing consumer market.

CHINA SEES FDI DROP FOLLOWING WESTERN DE-RISKING

Source: LPL Research, The World Bank 06/03/24

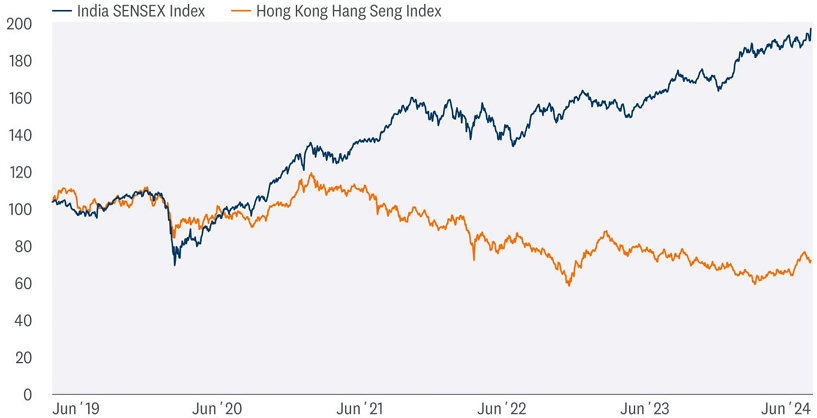

THE SENSEX AND NIFTY 50 REFLECT CONFIDENCE IN THE PRO-BUSINESS STRATEGY

The strength in the Indian stock indexes represented a clear referendum on the transformation of India within the emerging market complex, and a primary and formidable competitor to China’s domination within emerging markets.

The Indian markets markedly outperformed the Hang Seng Index — which lists mainland China’s shares — but recent efforts by Beijing to restore confidence, and now the perceived weakened stature of Modi’s third term, could favor Chinese shares.

Still, the consensus from emerging market analysts continues to favor India while acknowledging the resumption of interest in Chinese companies, even if the Chinese market is seen as a trader’s market.

SENSEX CONTINUES TO PULL AWAY FROM HANG SENG

Source: LPL Research, Bloomberg 06/03/24

Indexes are unmanaged and cannot be invested in directly. Past performance is no guarantee of future results.

MODI’S INDIA CONTINUES TO GROW

The latest figures for India’s gross domestic product (GDP) growth, 8.2% for the fiscal year through March, underscores the strength of the economy and the reforms that have been installed deeply into the economic base.

At the margin, the macroeconomic stability provided by Modi’s leadership should remain and continue, perhaps at a more manageable pace, but continue, nonetheless.

The composition of the cabinet and the upcoming July budget should provide a basis for global investors to assess the viability of India’s commanding status within emerging markets.

ASSET ALLOCATION INSIGHTS

LPL’s Strategic and Tactical Asset Allocation Committee (STAAC) maintains its tactical neutral stance on equities. Steady economic and earnings growth this year has kept the risk-reward trade-off for stocks and bonds fairly well balanced, but moving forward, with valuations for stocks elevated and bonds offering more attractive yields, we believe bonds hold a slight edge over stocks. Strong year-to-date stock market gains may have pulled forward some potential gains from Fed rate cuts, potentially leaving limited upside and more volatility over the balance of 2024 as the economy potentially slows.

Within equities, the STAAC continues to favor a tilt in the Tactical Asset Allocation (TAA) toward domestic over international equities, with a preference for Japan among developed markets. Despite current political uncertainty, the long-term opportunities in India’s equity market remain attractive. But the challenging climate for China investment leaves the Committee underweight emerging market equities. The Committee recommends a very modest tilt toward growth style and balanced market cap exposure across large, mid, and small caps.

Finally, the STAAC continues to recommend a modest overweight to fixed income, funded from cash.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

US Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from FactSet.

Value investments can perform differently from the market as a whole. They can remain undervalued by the market for long periods of time.

The prices of small cap stocks are generally more volatile than large cap stocks.

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

LPL Financial does not provide investment banking services and does not engage in initial public offerings or merger and acquisition activities.

This research material has been prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Deposits or Obligations | Not Bank/Credit Union Guaranteed | May Lose Value

RES-0001329-0524W | For Public Use | Tracking #589046 (Exp. 06/2025)